New to VHEIP? Register Now!

Benefits & Tax Advantages

529 plans have become the primary way that families save for college. With VHEIP, saving for college is easy (only $25 is needed to open an account!) and the plan offers tax advantages, especially for Vermont taxpayers. As Vermont’s official 529 college savings plan, VHEIP is the only 529 college savings plan that qualifies for the 10% Vermont state income tax credit on annual contributions or gifts.

It is the responsibility of the account owner and any contributor to VHEIP to maintain records necessary to respond to any questions from the Internal Revenue Service or the Vermont Department of Taxes related to contributions.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Vermont State Income Tax Credit

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit. It is the responsibility of the account owner and any contributor to VHEIP to maintain records necessary to respond to any questions from the Internal Revenue Service or the Vermont Department of Taxes related to contributions.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, 10% of the first $5,000 contributed per beneficiary) – a tax credit worth up to $250 per beneficiary ($500 per beneficiary for married couples filing jointly). Gifts made by a Vermont taxpayer to any VHEIP account are also eligible for the credit.

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the tax credit on the contributions portion of the rollover (not on the earnings portion). The funds must remain in VHEIP for the remainder of the tax year in order to claim the tax credit.

For details and examples, including information on non-qualified withdrawals, see the Vermont Department of Taxes Technical Bulletin (TB-66). Learn how to claim the Vermont income tax credit.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Other Tax Advantages

- Tax-free earnings. All contributions are after-tax. Any earnings are free of federal and state taxes, except in cases of a non-qualified withdrawal.

- Tax-free withdrawals. Withdrawals used for qualified higher education expenses – including eligible undergraduate, graduate, trade, technical, or non-degree study – are exempt from federal and state tax.

- No income limitations. Tax benefits are available regardless of income. There are also no income limitations on a person’s ability to open or contribute to a VHEIP account.

- Federal estate and gift tax benefits.Contributions to VHEIP may reduce the taxable value of your estate. Contributions to the plan, together with all other gifts from the account owner or third-party contributors to the beneficiary, may qualify for an annual federal gift tax exclusion of $18,000 per donor ($36,000 for married contributors), per beneficiary. If an account owner’s contribution to a VHEIP account for a beneficiary in a single year exceeds $18,000 ($36,000 for married contributors), the account owner may elect to treat up to $75,000 of the contributions, or $150,000 for joint filers, as having been made over a period of up to five years for federal gift tax exclusion. This means that an account owner (or a third-party contributor) may contribute up to $75,000 in a single year to an account without the contribution being considered a taxable gift, provided that the contributor makes no other gifts to the beneficiary in the same year in which the contribution is made and in any of the succeeding four calendar years. The contributor must make this election on his or her federal gift tax return by filing IRS Form 709. Consult your tax advisor.

- More on tax benefits for education. IRS Publication 970, Tax Benefits for Education, is a useful resource for individual taxpayers who have questions about 529 plans, referred to as Qualified Tuition Programs (QTPs) in the IRS code. See chapter 8 of the document for specifics and tips.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Low Minimum Contribution

Minimum contribution:

- $25 minimum for automatic contributions (you choose the schedule — monthly, quarterly, yearly, and more).

- $25 minimum for one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 minimum per pay period for payroll deduction contributions.

-

High Maximum Contribution

- No limit on contributions per beneficiary as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account contribution limit, but no more contributions will be accepted.

-

Low Plan Fees

VHEIP has low plan fees.

- No sales charges, no enrollment fees

- 0.39% annual asset-based program management fee to cover the cost of investment management and administration, including all underlying fund fees. For details, please see fees and expenses.

-

Flexible Features

- Anyone can open an account. Any individual — parent, grandparent, relative, and friend — who is a U.S. citizen or resident alien and has a Social Security Number or Tax Identification Number may open a VHEIP account and contribute to a beneficiary. You can even open an account for yourself. Vermont state residency is not required. A trust, estate, corporation, non-profit, or government entity can also open an account and contribute on behalf of a beneficiary.

- Many ways to contribute. You may set up automatic contributions from your bank account, sign up for payroll deduction with your employer, or make contributions online or by mail whenever you want to. You can also roll over funds from another state’s 529 program or from another college savings investment such as a Coverdell ESA or UGMA/UTMA.

- Choice of investment options, including age-based, diversified equity, equity index, balanced, fixed-income, and the Principal Plus Interest Option. See Investment Options & Performance for more info.

- Rebalance assets up to 2x per year. You may change investment options for money you have already invested into each VHEIP account two (2) times per calendar year, on whatever dates you choose. At any time you may change the investment options into which future contributions are deposited.

- No time limit for using funds. The money you accumulate can be used for a beneficiary’s qualified education expenses for undergraduate, graduate, and non-degree education any time during the account owner’s lifetime. You can name a contingent account owner, who will become the account owner if you die.

- Money can be transferred to another beneficiary. You may change the beneficiary at any time to another member of the previous beneficiary’s family. The account owner retains control over the account even when beneficiaries are changed.

- Ease of withdrawals. To make a withdrawal, the account owner simply requests the amount needed and selects where to have the funds sent: to the college, program, or beneficiary via check, or to the account owner via check or electronic deposit.

- Money can be withdrawn for non-education expenses. You control all use of the funds. However, if you make a non-qualified withdrawal, for any use other than paying qualified education expenses, you will pay state and federal income tax on the earnings portion of the withdrawal, plus a 10% penalty, and you must repay any Vermont state tax credit that was given for the contributions portion of the non-qualified withdrawal.

- Money can be withdrawn to repay student loans. Up to $10,000 can be used per the lifetime of a beneficiary to repay student loans for post-secondary education.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

-

Favorable Treatment for Financial Aid

- Funds in VHEIP are considered a parent asset, rather than a student asset, so have less impact on financial aid. Federal financial aid formulas dedicate a fairly small portion of the parents’ assets toward the student’s college costs — a maximum of 5.64% per year. A student’s assets, in contrast, are typically assessed at a rate of 20% in the financial aid formula for higher education. Assets in a 529 plan in which a parent or a student is the account owner are reported on the Free Application for Federal Student Aid (FAFSA) as an asset of the parent, and are thus assessed at the parent’s rate rather than at the student’s rate.

- VHEIP withdrawals are treated favorably. When funds are withdrawn by the parent account owner to pay for the beneficiary student’s qualified expenses for college or other training, the withdrawal is not counted as income for financial aid purposes.

- Savings plans reduce need for loans. Student loans often make up the bulk of college financial aid packages, and interest on the loans can significantly increase the long-term cost of paying for education. A 529 plan, on the other hand, can grow as you contribute, so saving helps reduce the amount a parent or student beneficiary may need to borrow to help pay for college expenses.

-

Funds Can Be Used at Eligible Institutions Worldwide

- Funds in the account may be used at any eligible higher educational institution in the U.S. and abroad, whether your beneficiary decides to go to an in-state or out-of-state public or private college or university, trade, technical, or graduate school.

- Money can be used for a variety of qualified education expenses based on the program’s cost of attendance. These include tuition, fees, books, required supplies and equipment, on-campus room and board costs or off-campus costs up to the standard amount for living on campus, and certain education expenses for students with special needs.

Federal tax reform info: The Internal Revenue Code includes provisions related to 529 plan accounts. See the Disclosure Booklet for details. In 2022, Vermont tax law was updated to add two new allowable uses of funds withdrawn from a VT529 account without adverse impact on the Vermont income tax credit: (1) for apprenticeship programs registered and certified with the U.S. Secretary of Labor and (2) for repayment of up to $10,000 per the lifetime of a beneficiary in student loans for post-secondary education at an approved postsecondary education institution. (See the VHEIP tax credit information on the VT Tax website.) Vermont tax law currently does not treat a rollover to a Roth IRA or a withdrawal used for K through 12 education expenses as an allowable use. Please consult your tax advisor for how this may affect your personal Vermont tax situation.

PDF files require the free Adobe Acrobat Reader. Get it here.

What are the requirements for checks?

- Checks should be made payable to the Vermont Higher Education Investment Plan.

- Contributions by check must be drawn on a banking institution located in the United States in U.S. dollars.

- You may contribute to VHEIP using:

- personal checks (excluding starter checks and cashier’s checks), bank drafts, or teller’s checks.

- checks issued by a financial institution or brokerage firm made payable to the account owner or the beneficiary and endorsed over to VHEIP by the account owner.

- a third-party personal check up to $10,000 that is endorsed over to VHEIP.

Contributions by check should be accompanied by a completed Additional Contribution by Mail Form or should include reference the VHEIP account number(s) to which the contribution should be applied.

×What are the minimum and maximum contribution limits?

- $25 minimum for automatic contributions (you choose the frequency schedule—monthly, quarterly, yearly, and more).

- $25 to make one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 to contribute per pay period via payroll deduction.

- No limit on contributions per beneficiary account as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account balance limit.

What is the Vermont state income tax credit?

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, each spouse) – that’s a credit of up to $250 on annual contributions per beneficiary per account owner ($500 per beneficiary for married couples filing jointly).

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the 10% tax credit on the contributions portion of the rollover (not on the earnings). The funds must remain in VHEIP for the remainder of the taxable year in which the funds were rolled in.

Who is considered a family member of a 529 beneficiary?

A qualifying family member includes any siblings or step-siblings, natural or legally adopted children, stepchildren, parents or ancestors of parents, step-parents, first cousins, nieces or nephews, and aunts or uncles. In addition, the spouse of the beneficiary or the spouse of any of those listed above also qualifies as a family member of the beneficiary.

×Qualified higher education expenses include tuition, fees, and the cost of books, supplies, and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, and certain room and board expenses. Qualified higher education expenses also include certain additional enrollment and attendant costs of a beneficiary who is a special needs beneficiary in connection with the beneficiary’s enrollment or attendance at an eligible institution. For this purpose, an eligible educational institution generally includes accredited postsecondary educational institutions offering credit toward a bachelor’s degree, an associate’s degree, a graduate-level degree or professional degree, or another recognized postsecondary credential.

×A non-qualified withdrawal is any withdrawal that does not meet the requirements of being: (1) a qualified withdrawal; (2) a taxable withdrawal; or (3) a rollover. The earnings portion of a non-qualified withdrawal may be subject to federal income taxation, and the additional tax. Recapture provisions apply. See the Disclosure Booklet for details.

×Eligible education institutions are accredited, post-secondary educational institutions offering credit towards a bachelor’s degree, an associate’s degree, a graduate level or professional degree, or another recognized post-secondary credential. Use the Federal School Code Search on the Free Application for Federal Student Aid (FAFSA) website or contact your school to determine if it qualifies as an eligible educational institution. 529 Plan assets can also be used at some accredited foreign schools. If you have a question, contact your school to determine if it qualifies.

×The federal tax act of 2017, signed into law in December 2017, includes provisions related to 529 plan accounts, beginning with the 2018 tax year:

- 529 withdrawals may be used to pay for qualified K-12 expenses for elementary or secondary public, private or religious schools effective January 1, 2018. These K-12 withdrawals are limited to $10,000 per student per year and apply to tuition expenses only. Withdrawals up to $10,000 per year per beneficiary for K-12 tuition expenses are not subject to federal tax, but the earnings on those withdrawals over $10,000 would be subject to federal tax.

- The Vermont 529 plan statute is written differently, however, and may impose negative Vermont income tax consequences on withdrawals for K-12 tuition. Therefore, for account owners who took the Vermont income tax credit on contributions to their 529 plan, amounts withdrawn for K-12 tuition expenses may be subject to a 10% recapture penalty on those withdrawals, and Vermont may impose tax on the gain realized with respect to the withdrawals.

VSAC, as administrator of the Vermont 529 plan, will provide information as details about the Vermont income tax effects are clarified. We encourage you to consult a qualified tax advisor or the Vermont Department of Taxes at tax.vermont.gov concerning federal and state tax implications for tax years 2018 and beyond, and to save documentation for how all VT 529 fund withdrawals are used.

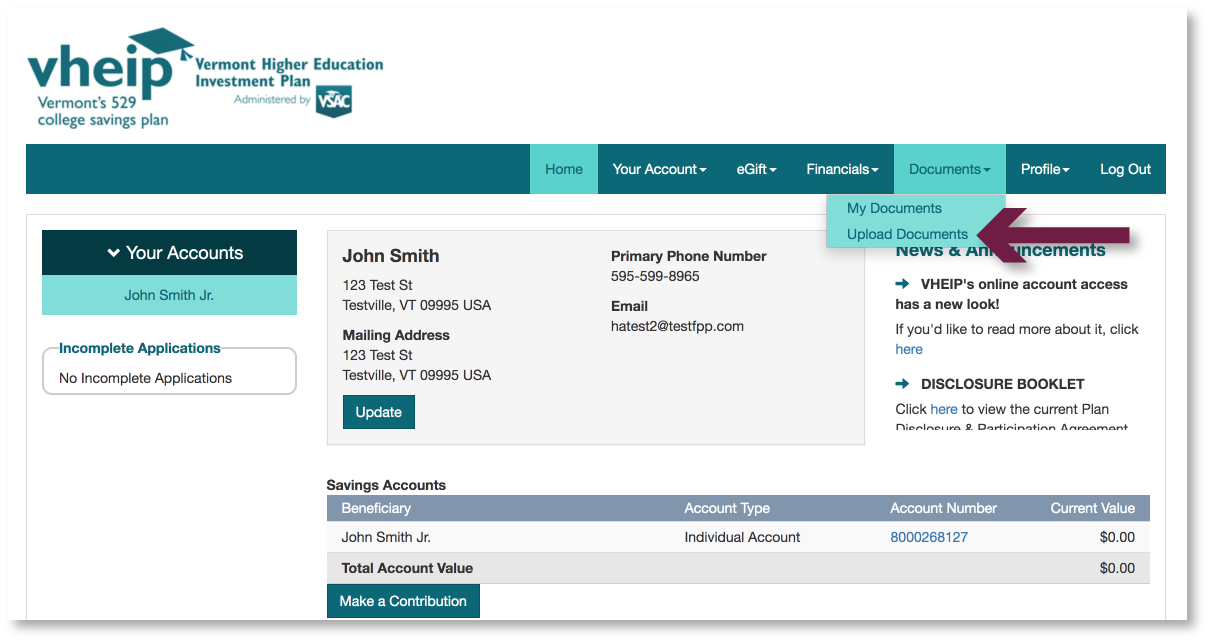

×Need to send us a document? Upload it online!

Simply login to your account and navigate to Upload Documents, located under the Documents tab.