New to VHEIP? Register Now!

College Planning Resources

For most families, saving enough to pay for the costs of higher education can seem overwhelming. However, with some planning, funding a college education can be easier to achieve than you might think. And every dollar saved now for college or training is money you won’t need to borrow later on. Plus, as Vermont’s official 529 college savings plan, VHEIP is the only 529 college savings plan that qualifies for the 10% Vermont state income tax credit on annual contributions or gifts to your account.

A VHEIP 529 college savings account can help you make a child’s college education possible. See what a difference you can make by preparing for college now.

-

Why Save for College?

A college education is one of the most important investments you can make in your child or loved one’s future. Students from families who save even a small amount for education are three times more likely to attend and complete college (Source: Vermont’s Financial Literacy Action Plan).

And the results of that investment continue for a lifetime: Reports show that college graduates experience higher earnings, higher job satisfaction, and healthier lifestyles than individuals without a college degree (Source: College Board). Read more about the value of a college education, and how to create a plan for college.

By contributing now …

Your savings can add up over time.

By saving early and contributing regularly now, you’ll be better able to help pay for college when your children are ready. Even small amounts can add up over time, as your child grows. Click here for estimates of what a 529 account might accumulate by setting aside monthly contributions for 5, 10, 15, and 18 years.

Your savings reduce future debt.

Because most families are unable to save 100% of the costs for college, students and their parents typically rely on education loans to pay for at least part of the college expense. By putting aside even a modest amount of savings now, families can reduce their reliance on loans, and earn interest rather than pay interest on money borrowed to cover those costs. See how saving and investing for college instead of relying on loans can cut your costs by more than half.

-

What Is a 529 Plan?

A 529 plan is an education savings plan designed to help families set aside funds for future college costs, with tax advantages to help make saving easier. The plans are named after Section 529 of the Internal Revenue Code, which created these types of savings plans in 1996. Most 529 plans are operated by state agencies. Vermont’s 529 plan, the Vermont Higher Education Investment Plan (VHEIP), is sponsored by VSAC, the state’s higher education agency.

For specifics about Vermont’s college saving plan, including details on the Vermont state income tax credit on contributions, see Benefits & Tax Advantages.

-

Savings & Financial Aid

One of the biggest myths of planning for college is that by saving, you’ll hurt your student’s chances for getting financial aid. Actually, putting aside money for college in Vermont’s 529 program can reduce what you need to borrow and pay back in financial aid loans. Plus, Vermont residents can get a tax credit on annual contributions to their 529 accounts.

FACT: Funds saved in 529 plans are generally considered to be a parent asset, so have less impact on financial aid.

Federal financial aid formulas dedicate a fairly small portion of the parents’ assets toward the student’s college costs – a maximum of 5.64% per year. A student’s assets, in contrast, are typically assessed at a rate of 20% in the need-based financial aid formulas.

So for financial aid purposes, placing assets in a 529 college savings plan is preferable to using other types of savings accounts. And because loans are a large part (approximately 60%) of a student’s financial aid package, putting money aside for college expenses can reduce the amount that families need to borrow and repay with interest. Any savings that a family can put away, even in small increments, will help reduce college debt.

See Benefits & Tax Advantages for more about the favorable treatment of savings in a VHEIP account for financial aid consideration, and get more details about how 529 plans are assessed for financial aid from the CSPN 529 website.

For more about college costs and financial aid, including how to fill out the Free Application for Federal Student Aid (FAFSA) and the Vermont grant, go to VSAC’s FAFSA First page. We’ll help you navigate the way!

-

Why It's Never Too Late to Save

Whether your child or loved one is an infant or teen, the sooner you get started, the better chance you have of reaching your college savings goal. Right now is the time to start, whatever the age of your child. Even if a student is in high school or in college, you can still benefit from federal and state tax advantages such as the Vermont state income tax credit on annual contributions.

Start now with small contributions, and contribute monthly. Regular contributions, however modest, make a difference in the long run.

-

College Cost Calculators & 529 Tools

You can find general 529 college savings plan tools and college cost calculators at collegesavings.org.

For guidance on planning and paying for college, see VSAC’s financial planning for college resources.

-

Top Myths about 529 College Savings Plans

- MYTH: 529 plans are only for wealthy investors.

FACT: 529 plans have much lower required minimum contribution amounts than many other investments, making them accessible and convenient for families of all income levels. Families can contribute as little as $15 or $25 per month with VHEIP.

- MYTH: I can just take out loans to pay for college, or my child will get financial aid.

FACT: Approximately 60% of federal financial aid comes in the form of student loans. All loans are borrowed money that a family must repay. Any savings that a family can put away, even in small increments, will help reduce the need for borrowing to pay for college.

- MYTH: 529 plans are only for young children.

FACT: There is no maximum age for a 529 plan. Assets may be used at eligible schools offering adult career training or advanced degrees, including part-time programs. Contributions to a VHEIP account even when a child is in high school or college are eligible for a 10% tax credit per year per beneficiary for Vermont taxpayers.

- MYTH: If I save now, my child won’t be eligible to receive as much financial aid later.

FACT: The Deficit Reduction Act of 2005 specifies that funds saved in 529 plans are generally considered to be parental assets, which means that less than 6% of these assets are currently counted towards the family’s expected contribution in federal need-based financial aid calculations.

- MYTH: A 529 plan can only be used at schools in my home state.

FACT: Assets from 529 plans may be used at any school that is accredited and eligible to accept federal financial aid. This includes nearly all public and private colleges in the United States and many trade and technical schools. It even includes some colleges located outside of the U.S.

- MYTH: A 529 plan can only be used for a four-year college.

FACT: Assets from 529 plans may be used at any eligible school, including two- and four-year colleges, graduate schools and vocational and technical schools. Funds may be used for tuition, fees, certain room and board costs, and required computers and course-related software.

- MYTH: If my child doesn’t go to college, I will lose my money.

FACT: A 529 account owner can change the plan’s beneficiary to another eligible family member or even oneself with no tax penalty. The money saved can also be left to grow and be used by the next generation of family members for qualified education expenses. If the money is ever needed for non-qualified use, it can also be withdrawn at any time.

- MYTH: Opening a 529 plan is complicated.

FACT: Opening a VHEIP account is easy! You can choose to open it online or by mail, with an initial contribution of $25.

(Source: Adapted from the College Savings Plans Network (CSPN), a non-profit association affiliated with the National Association of State Treasurers (NAST) that brings together state administrators of 529 savings plans. Information is available on CSPN’s Web site www.collegesavings.org.)

- MYTH: 529 plans are only for wealthy investors.

-

Plan for College with VSAC

As you plan for education after high school, VSAC is here to help!

VSAC was established in 1965 to help Vermonters achieve their education and training goals after high school. We have more than 50 years’ experience helping Vermont students and families get the education they desire.

We provide:

Free college savings and planning events

- Saving for college events at libraries, community organizations, employers, child care centers, and schools. See the calendar or contact us to request a presentation.

- College & Career Pathways events on Vermont college campuses in the spring for VT high school students and their parents

- Paying for college and financial aid workshops at VT high schools and colleges

College planning & financial aid information at vsac.org/plan includes

- tools for students to identify interests, skills, and work values

- links to careers, majors, and education

- resources for students to prepare for college work

- specifics on how to apply to & pay for college

- college and scholarship searches

Grants & scholarships

- state grants for full-time and part-time degree programs

- state grants for non-degree courses to try a college class or improve employability

- info on more than 140 scholarships for Vermont students

Education loans

- VSAC offers the Vermont Advantage fixed-rate student and parent loans. Get details on current low interest rates and the benefits for Vermont students or families. Compare rates and terms with the federal Direct parent PLUS loans.

- Evaluate financial aid awards and learn the basics of education loans, with guidance for minimizing debt. Be a smart borrower: Download VSAC’s must-read My Education Loans guide.

PDF files require the free Adobe Acrobat Reader. Get it here.

What are the requirements for checks?

- Checks should be made payable to the Vermont Higher Education Investment Plan.

- Contributions by check must be drawn on a banking institution located in the United States in U.S. dollars.

- You may contribute to VHEIP using:

- personal checks (excluding starter checks and cashier’s checks), bank drafts, or teller’s checks.

- checks issued by a financial institution or brokerage firm made payable to the account owner or the beneficiary and endorsed over to VHEIP by the account owner.

- a third-party personal check up to $10,000 that is endorsed over to VHEIP.

Contributions by check should be accompanied by a completed Additional Contribution by Mail Form or should include reference the VHEIP account number(s) to which the contribution should be applied.

×What are the minimum and maximum contribution limits?

- $25 minimum for automatic contributions (you choose the frequency schedule—monthly, quarterly, yearly, and more).

- $25 to make one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 to contribute per pay period via payroll deduction.

- No limit on contributions per beneficiary account as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account balance limit.

What is the Vermont state income tax credit?

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, each spouse) – that’s a credit of up to $250 on annual contributions per beneficiary per account owner ($500 per beneficiary for married couples filing jointly).

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the 10% tax credit on the contributions portion of the rollover (not on the earnings). The funds must remain in VHEIP for the remainder of the taxable year in which the funds were rolled in.

Who is considered a family member of a 529 beneficiary?

A qualifying family member includes any siblings or step-siblings, natural or legally adopted children, stepchildren, parents or ancestors of parents, step-parents, first cousins, nieces or nephews, and aunts or uncles. In addition, the spouse of the beneficiary or the spouse of any of those listed above also qualifies as a family member of the beneficiary.

×Qualified higher education expenses include tuition, fees, and the cost of books, supplies, and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, and certain room and board expenses. Qualified higher education expenses also include certain additional enrollment and attendant costs of a beneficiary who is a special needs beneficiary in connection with the beneficiary’s enrollment or attendance at an eligible institution. For this purpose, an eligible educational institution generally includes accredited postsecondary educational institutions offering credit toward a bachelor’s degree, an associate’s degree, a graduate-level degree or professional degree, or another recognized postsecondary credential.

×A non-qualified withdrawal is any withdrawal that does not meet the requirements of being: (1) a qualified withdrawal; (2) a taxable withdrawal; or (3) a rollover. The earnings portion of a non-qualified withdrawal may be subject to federal income taxation, and the additional tax. Recapture provisions apply. See the Disclosure Booklet for details.

×Eligible education institutions are accredited, post-secondary educational institutions offering credit towards a bachelor’s degree, an associate’s degree, a graduate level or professional degree, or another recognized post-secondary credential. Use the Federal School Code Search on the Free Application for Federal Student Aid (FAFSA) website or contact your school to determine if it qualifies as an eligible educational institution. 529 Plan assets can also be used at some accredited foreign schools. If you have a question, contact your school to determine if it qualifies.

×The federal tax act of 2017, signed into law in December 2017, includes provisions related to 529 plan accounts, beginning with the 2018 tax year:

- 529 withdrawals may be used to pay for qualified K-12 expenses for elementary or secondary public, private or religious schools effective January 1, 2018. These K-12 withdrawals are limited to $10,000 per student per year and apply to tuition expenses only. Withdrawals up to $10,000 per year per beneficiary for K-12 tuition expenses are not subject to federal tax, but the earnings on those withdrawals over $10,000 would be subject to federal tax.

- The Vermont 529 plan statute is written differently, however, and may impose negative Vermont income tax consequences on withdrawals for K-12 tuition. Therefore, for account owners who took the Vermont income tax credit on contributions to their 529 plan, amounts withdrawn for K-12 tuition expenses may be subject to a 10% recapture penalty on those withdrawals, and Vermont may impose tax on the gain realized with respect to the withdrawals.

VSAC, as administrator of the Vermont 529 plan, will provide information as details about the Vermont income tax effects are clarified. We encourage you to consult a qualified tax advisor or the Vermont Department of Taxes at tax.vermont.gov concerning federal and state tax implications for tax years 2018 and beyond, and to save documentation for how all VT 529 fund withdrawals are used.

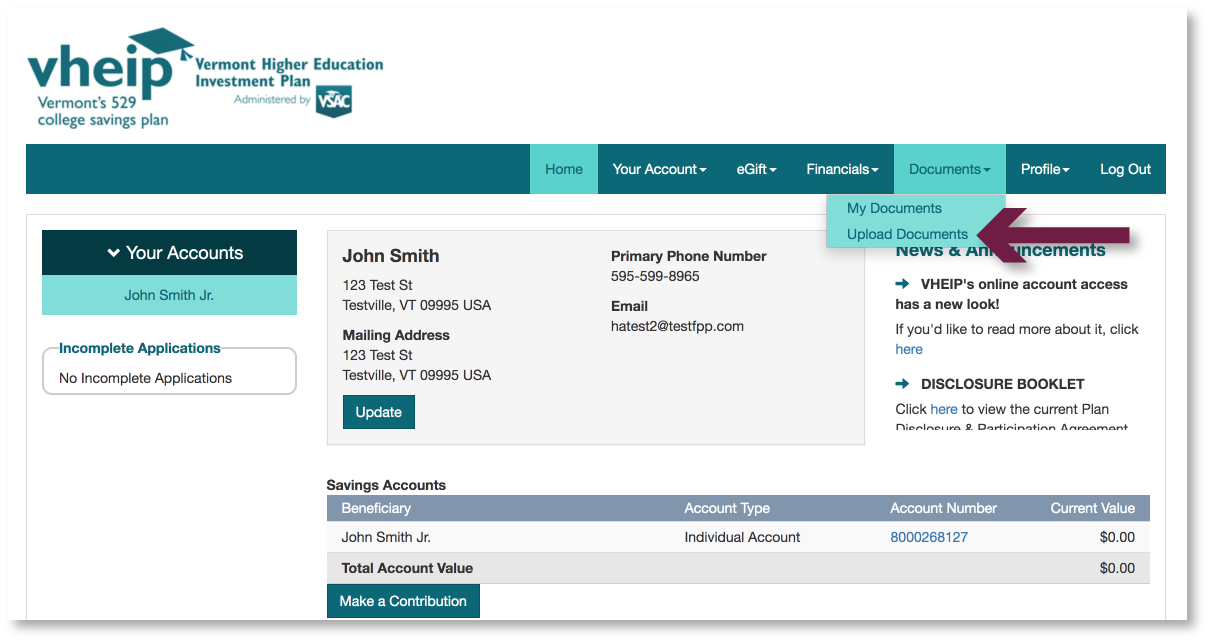

×Need to send us a document? Upload it online!

Simply login to your account and navigate to Upload Documents, located under the Documents tab.