New to VHEIP? Register Now!

Contact Us

We’re ready to help you. Here’s how to reach us.

To contact customer service or manage your VHEIP account:

Phone:

1-800-637-5860

Monday through Friday, 8:00 am – 7:00 pm ET

Email:

Mail:

Vermont Higher Education Investment Plan

Managed by Intuition College Savings Solutions

PO Box 44002

Jacksonville, FL 32231-4002

-

Request a Presentation

To request a saving for college presentation, workshop, or VHEIP information for your event or school:

Phone: 1-800-642-3177 or (802) 655-9602 (select 6 for the VHEIP option)

Email: events@vsac.org

Are you a school counselor or principal? We can meet with parents at your school to help them learn about saving for their children’s education. Contact us and we’ll get in the school events schedule!

What are the requirements for checks?

- Checks should be made payable to the Vermont Higher Education Investment Plan.

- Contributions by check must be drawn on a banking institution located in the United States in U.S. dollars.

- You may contribute to VHEIP using:

- personal checks (excluding starter checks and cashier’s checks), bank drafts, or teller’s checks.

- checks issued by a financial institution or brokerage firm made payable to the account owner or the beneficiary and endorsed over to VHEIP by the account owner.

- a third-party personal check up to $10,000 that is endorsed over to VHEIP.

Contributions by check should be accompanied by a completed Additional Contribution by Mail Form or should include reference the VHEIP account number(s) to which the contribution should be applied.

×What are the minimum and maximum contribution limits?

- $25 minimum for automatic contributions (you choose the frequency schedule—monthly, quarterly, yearly, and more).

- $25 to make one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 to contribute per pay period via payroll deduction.

- No limit on contributions per beneficiary account as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account balance limit.

What is the Vermont state income tax credit?

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, each spouse) – that’s a credit of up to $250 on annual contributions per beneficiary per account owner ($500 per beneficiary for married couples filing jointly).

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the 10% tax credit on the contributions portion of the rollover (not on the earnings). The funds must remain in VHEIP for the remainder of the taxable year in which the funds were rolled in.

Who is considered a family member of a 529 beneficiary?

A qualifying family member includes any siblings or step-siblings, natural or legally adopted children, stepchildren, parents or ancestors of parents, step-parents, first cousins, nieces or nephews, and aunts or uncles. In addition, the spouse of the beneficiary or the spouse of any of those listed above also qualifies as a family member of the beneficiary.

×Qualified higher education expenses include tuition, fees, and the cost of books, supplies, and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, and certain room and board expenses. Qualified higher education expenses also include certain additional enrollment and attendant costs of a beneficiary who is a special needs beneficiary in connection with the beneficiary’s enrollment or attendance at an eligible institution. For this purpose, an eligible educational institution generally includes accredited postsecondary educational institutions offering credit toward a bachelor’s degree, an associate’s degree, a graduate-level degree or professional degree, or another recognized postsecondary credential.

×A non-qualified withdrawal is any withdrawal that does not meet the requirements of being: (1) a qualified withdrawal; (2) a taxable withdrawal; or (3) a rollover. The earnings portion of a non-qualified withdrawal may be subject to federal income taxation, and the additional tax. Recapture provisions apply. See the Disclosure Booklet for details.

×Eligible education institutions are accredited, post-secondary educational institutions offering credit towards a bachelor’s degree, an associate’s degree, a graduate level or professional degree, or another recognized post-secondary credential. Use the Federal School Code Search on the Free Application for Federal Student Aid (FAFSA) website or contact your school to determine if it qualifies as an eligible educational institution. 529 Plan assets can also be used at some accredited foreign schools. If you have a question, contact your school to determine if it qualifies.

×The federal tax act of 2017, signed into law in December 2017, includes provisions related to 529 plan accounts, beginning with the 2018 tax year:

- 529 withdrawals may be used to pay for qualified K-12 expenses for elementary or secondary public, private or religious schools effective January 1, 2018. These K-12 withdrawals are limited to $10,000 per student per year and apply to tuition expenses only. Withdrawals up to $10,000 per year per beneficiary for K-12 tuition expenses are not subject to federal tax, but the earnings on those withdrawals over $10,000 would be subject to federal tax.

- The Vermont 529 plan statute is written differently, however, and may impose negative Vermont income tax consequences on withdrawals for K-12 tuition. Therefore, for account owners who took the Vermont income tax credit on contributions to their 529 plan, amounts withdrawn for K-12 tuition expenses may be subject to a 10% recapture penalty on those withdrawals, and Vermont may impose tax on the gain realized with respect to the withdrawals.

VSAC, as administrator of the Vermont 529 plan, will provide information as details about the Vermont income tax effects are clarified. We encourage you to consult a qualified tax advisor or the Vermont Department of Taxes at tax.vermont.gov concerning federal and state tax implications for tax years 2018 and beyond, and to save documentation for how all VT 529 fund withdrawals are used.

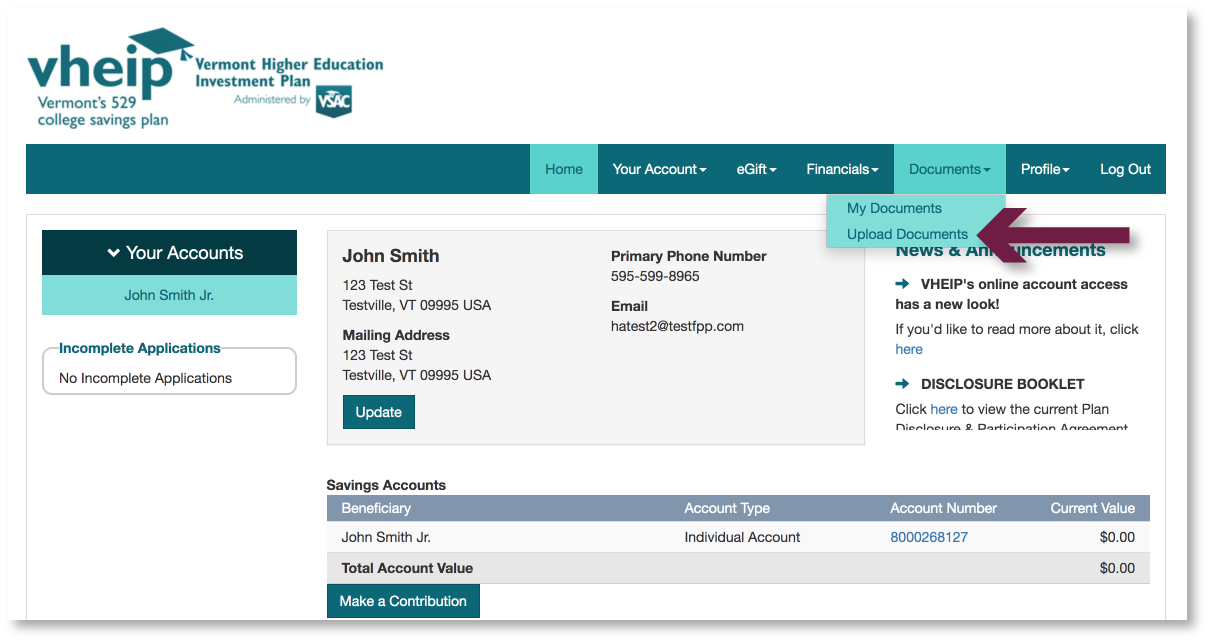

×Need to send us a document? Upload it online!

Simply login to your account and navigate to Upload Documents, located under the Documents tab.