New to VHEIP? Register Now!

Give a Gift

Education is the gift that lasts a lifetime. Just about any job your children or loved ones can dream about will require some form of education after high school. Saving now for that training creates career opportunities for the future. And with Vermont’s state-sponsored 529 plan, you can open an account with as little as $25 or give any amount as a gift. Grandparents, family and friends can give, too!

Get tax benefits. The Vermont Higher Education Investment Plan/VT529 is the only savings program that qualifies for a 10% Vermont income tax credit on annual contributions or rollovers for college or training. Deposits made by December 31 qualify for the tax credit. Gifts made by others into a VT529 account may also qualify.

Choose your way to give (Click the links for instructions):

- Gift Option 1: Open an NEW account.

- Gift Option 2: Add to an EXISTING VT529 account owned by someone else.

- Gift Option 3 (for account owners): Invite others to give a gift to your VT529 accounts via eGift.

- Gift Option 4: Purchase or redeem a Gift of College gift card.

-

Gift Option 1: Open a NEW account

- Follow the instructions at Open an Account. The beneficiary of the account will be the person to whom you wish to give a gift. You will need to know the Social Security Number (SSN) or federal Taxpayer Identification Number of the beneficiary and his or her birth date and street address (not PO Box) to complete the account enrollment process. You are the owner of the account.

- Once your account has been established, download and print out a Gift of Education Certificate.

Did you know: As the account owner, you are eligible for tax advantages for contributions to a VHEIP account. Find out more.

-

Gift Option 2: Add to an EXISTING VT529 account

- An account owner of an already opened VHEIP account can create eGift events and send email invitations at any time, for as many friends and family as they would like. When you receive one of these invitations, you will be able to contribute directly to the account owner’s VHEIP account or accounts via electronic funds transfer (EFT). Find out more.

- All other gift contributions should be accompanied by a completed Gift Contribution Form or should include the VHEIP account number(s) to which the gift should be applied.

- Don’t forget to download the Gift of Education Certificate and give it to your loved one once you have made your gift.

-

Gift Option 3 (for account owners): Invite others to give a gift via eGift

With our eGift option, you can invite family and friends to make a contribution through VHEIP’s secure website. There are no checks to be mailed or deposited. With just a few clicks, the gift goes right into the child’s VHEIP account. It’s safe, secure, and convenient. Log in to your account to get started.

- Once you have logged in to your account, go to the eGift link on the top of the page.

- Create an eGift “event.”

- Tell us which beneficiary(s) you want the eGift invitation for. If you would like to send an invitation for all of your beneficiaries at the same time, you can do it through one eGift invitation.

- Indicate the email address(es) of the individuals who will receive the invitation.

- Personalize your eGift email invitation and signature, and confirm the eGift event.

- If you want to automatically create the same eGift invitation every year, you’ll have an option to set it up as a recurring event.

That’s it! Here’s what happens next:

- When your eGift event is created, an email will go to all the recipients you specified. Once they receive it, they can click a payment link in the email to contribute electronically. If you designated more than one beneficiary, they can contribute to multiple beneficiaries at the same time.

- Once a gift has been made, we’ll process the electronic payment into your VHEIP account(s) from their bank account. You can even send a thank you message right from your VHEIP account.

- Log in to your account at any time to see all of your eGift and gifted contributions.

-

Gift Option 4: Purchase or redeem a Gift of College gift card

VSAC, state administrator of the VT529 college savings program, offers Gift of College gift cards in $50 amounts at Vermont locations of Cumberland Farms stores. Specific stores locations are listed on the Gift of College website Buy-In-Store link.

Already have a gift card? Here’s how to register and redeem your card. -

Gifting FAQs

Federal tax reform info: The federal tax act of 2017 includes provisions related to 529 plan accounts. See the Disclosure Booklet for details.

Questions? Find answers here or give us a call toll-free at 1-800-637-5860, Mon – Fri, 8:00 am – 7:00 pm ET.

What is the minimum gift amount?

There is no minimum amount that friends and family members may contribute (gift) to your existing account(s).

I’m a grandparent, relative, or family friend. Rather than open my own account, can I just make a contribution to VHEIP accounts already established by others for my grandchildren or loved ones?

Yes! You may contribute to a VHEIP account already set up for a beneficiary (or to multiple VHEIP accounts), and not maintain your own accounts for each child or loved one for whom you wish to make a gift. You can contribute online via electronic funds or by mail with a check. Learn how.

Individuals can also purchase a VSAC Gift of College gift card in $50 amounts at the Vermont locations of Cumberland Farms stores. Learn more about purchasing or redeeming a VSAC Gift of College gift card.

It is the responsibility of the account owner and any contributor to VHEIP to maintain records necessary to respond to any questions from the Internal Revenue Service or the Vermont Department of Taxes related to contributions.

If you are a Vermont taxpayer, you may qualify for a 10% Vermont income tax credit on your annual gift contributions into a VHEIP account. Learn more about the Vermont tax credit.

Can a beneficiary have more than one VHEIP account?

Each account can have only one account owner and one beneficiary. However, each beneficiary may have more than one account, and you may open separate accounts for as many different beneficiaries as you wish. Friends and family members may open a separate account for your beneficiary. They will need to know the Social Security Number or federal Taxpayer Identification Number of your beneficiary and his or her birth date and street address (not PO Box) to complete the account enrollment process.

Can friends or family see my VHEIP account if I invite them to make a gift?

No. Only the account owner has access to account details. Gift givers can only contribute to the account. They cannot perform any transactions or see account details.

How are gift contributions invested?

Contributions to a VHEIP account are invested according to the investment portfolios and allocations established by the account owner for his/her account. Friends and family members can contribute to the account, but only account owners can access the account and make changes to investment allocations.

What impact, if any, do IRS Gift Law Limits have?

Contributions into a VHEIP account may reduce the taxable value of your estate. Your contributions, together with all other gifts from the account owner or third-party contributors to the designated beneficiary, may qualify for an annual federal gift tax exclusion of $15,000 per donor, per designated beneficiary. If your contribution to a VHEIP account for one beneficiary exceeds that $15,000 (or $30,000 for joint filers) exclusion, you may elect to treat up to $75,000 of the contributions (or $150,000 for joint filers) as having been made over a period of up to five years for purposes of determining your annual federal gift tax exclusion. This means that an account owner or a third-party contributor may contribute up to $75,000 in a single year to an account without the contribution being considered a taxable gift, provided that the contributor makes no other gifts to the beneficiary in the same year in which the contribution is made and in any of the succeeding four calendar years. The contributor must make this election on his or her federal gift tax return by filing IRS Form 709. Consult your tax advisor for additional details.

PDF files require the free Adobe Acrobat Reader. Get it here.

What are the requirements for checks?

- Checks should be made payable to the Vermont Higher Education Investment Plan.

- Contributions by check must be drawn on a banking institution located in the United States in U.S. dollars.

- You may contribute to VHEIP using:

- personal checks (excluding starter checks and cashier’s checks), bank drafts, or teller’s checks.

- checks issued by a financial institution or brokerage firm made payable to the account owner or the beneficiary and endorsed over to VHEIP by the account owner.

- a third-party personal check up to $10,000 that is endorsed over to VHEIP.

Contributions by check should be accompanied by a completed Additional Contribution by Mail Form or should include reference the VHEIP account number(s) to which the contribution should be applied.

×What are the minimum and maximum contribution limits?

- $25 minimum for automatic contributions (you choose the frequency schedule—monthly, quarterly, yearly, and more).

- $25 to make one-time contributions by check, electronic funds transfer (EFT), or recurring ACH.

- $15 to contribute per pay period via payroll deduction.

- No limit on contributions per beneficiary account as long as the total balance of all accounts for that beneficiary does not exceed $550,000.

- Accounts may continue to accrue earnings even if they have reached the maximum account balance limit.

What is the Vermont state income tax credit?

As Vermont’s official 529 college savings plan, VHEIP is the only 529 plan that qualifies for a Vermont state income tax credit.

- A state income tax credit of 10% of the first $2,500 contributed to VHEIP per beneficiary per tax year is available to any Vermont taxpayer (or, in the case of a married couple filing jointly, each spouse) – that’s a credit of up to $250 on annual contributions per beneficiary per account owner ($500 per beneficiary for married couples filing jointly).

- Rollovers from another state’s 529 plan into VHEIP are also eligible for the 10% tax credit on the contributions portion of the rollover (not on the earnings). The funds must remain in VHEIP for the remainder of the taxable year in which the funds were rolled in.

Who is considered a family member of a 529 beneficiary?

A qualifying family member includes any siblings or step-siblings, natural or legally adopted children, stepchildren, parents or ancestors of parents, step-parents, first cousins, nieces or nephews, and aunts or uncles. In addition, the spouse of the beneficiary or the spouse of any of those listed above also qualifies as a family member of the beneficiary.

×Qualified higher education expenses include tuition, fees, and the cost of books, supplies, and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, and certain room and board expenses. Qualified higher education expenses also include certain additional enrollment and attendant costs of a beneficiary who is a special needs beneficiary in connection with the beneficiary’s enrollment or attendance at an eligible institution. For this purpose, an eligible educational institution generally includes accredited postsecondary educational institutions offering credit toward a bachelor’s degree, an associate’s degree, a graduate-level degree or professional degree, or another recognized postsecondary credential.

×A non-qualified withdrawal is any withdrawal that does not meet the requirements of being: (1) a qualified withdrawal; (2) a taxable withdrawal; or (3) a rollover. The earnings portion of a non-qualified withdrawal may be subject to federal income taxation, and the additional tax. Recapture provisions apply. See the Disclosure Booklet for details.

×Eligible education institutions are accredited, post-secondary educational institutions offering credit towards a bachelor’s degree, an associate’s degree, a graduate level or professional degree, or another recognized post-secondary credential. Use the Federal School Code Search on the Free Application for Federal Student Aid (FAFSA) website or contact your school to determine if it qualifies as an eligible educational institution. 529 Plan assets can also be used at some accredited foreign schools. If you have a question, contact your school to determine if it qualifies.

×The federal tax act of 2017, signed into law in December 2017, includes provisions related to 529 plan accounts, beginning with the 2018 tax year:

- 529 withdrawals may be used to pay for qualified K-12 expenses for elementary or secondary public, private or religious schools effective January 1, 2018. These K-12 withdrawals are limited to $10,000 per student per year and apply to tuition expenses only. Withdrawals up to $10,000 per year per beneficiary for K-12 tuition expenses are not subject to federal tax, but the earnings on those withdrawals over $10,000 would be subject to federal tax.

- The Vermont 529 plan statute is written differently, however, and may impose negative Vermont income tax consequences on withdrawals for K-12 tuition. Therefore, for account owners who took the Vermont income tax credit on contributions to their 529 plan, amounts withdrawn for K-12 tuition expenses may be subject to a 10% recapture penalty on those withdrawals, and Vermont may impose tax on the gain realized with respect to the withdrawals.

VSAC, as administrator of the Vermont 529 plan, will provide information as details about the Vermont income tax effects are clarified. We encourage you to consult a qualified tax advisor or the Vermont Department of Taxes at tax.vermont.gov concerning federal and state tax implications for tax years 2018 and beyond, and to save documentation for how all VT 529 fund withdrawals are used.

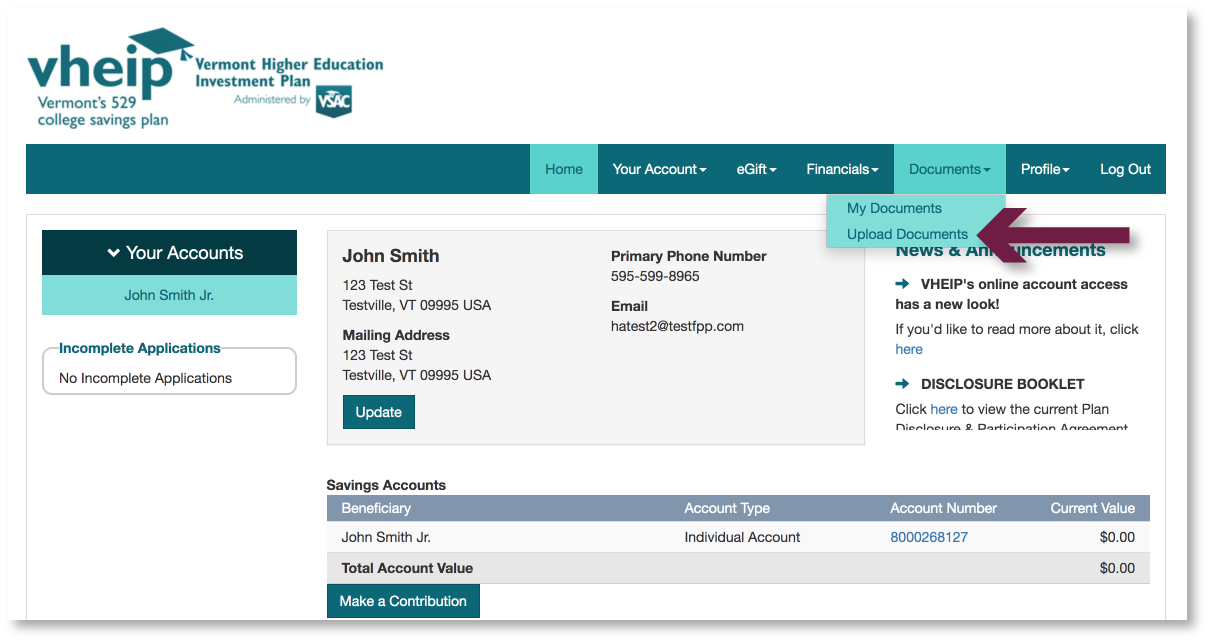

×Need to send us a document? Upload it online!

Simply login to your account and navigate to Upload Documents, located under the Documents tab.